High integrity onchain data

Clean, reconciled, block-level data sourced from minted blocks on different networks and updated continuously. The foundation for accurate underwriting, pricing, and portfolio analysis in an onchain economy.

.webp)

Data you can defend to committees

Bitpulse provides the data integrity, simulation tools, and monitoring infrastructure institutions need to participate in onchain markets with confidence.

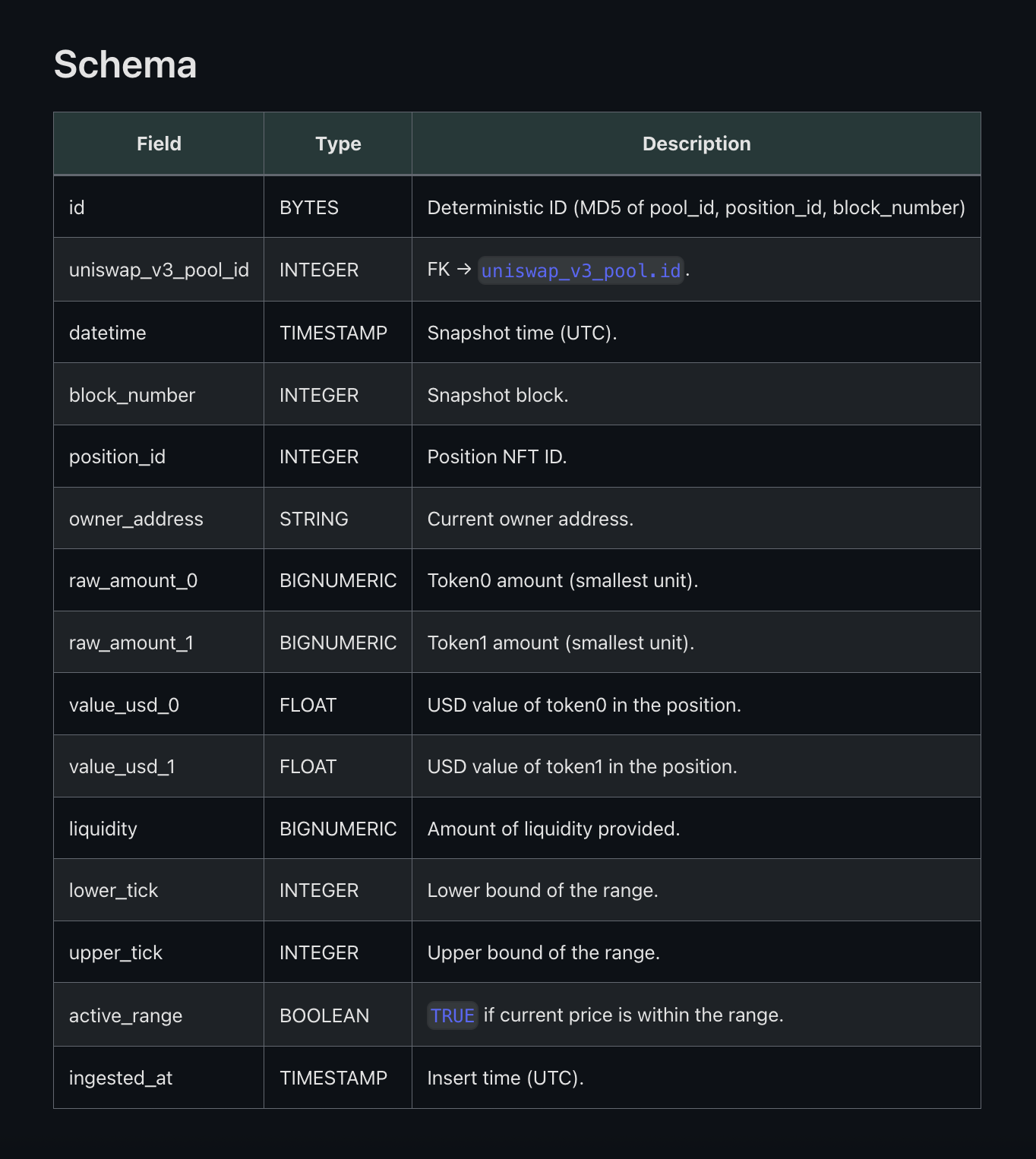

Base tables available:

- Liquidity depth and distributions

- Swap volumes and frequencies

- Total value locked (TVL)

- Positions

- Derived OHLCV series computed from onchain trades and integrated venue feeds, documented per asset

Examples of supported risk metrics:

- Nakamoto coefficient

- Amihud ratio

- Shannon entropy

- Volume distribution

- Liquidity stability

- Historical APY Volatility

Coverage across

- Multiple blockchain networks

- DeFi protocols

- Decentralized exchanges

- Smart contract pools

Built from chain truth, not estimates

Deterministic vs heuristic collection

Heuristic approaches estimate liquidity from incomplete data sources. We prioritize deterministic collection and reconciliation across chains and protocols. The Bitpulse Standard ensures consistency of liquidity snapshots across any network and protocol.

Genesis block foundation

Initial one time pull captures complete historical state. Delta-delta checkpoint system maintains synchronization as new blocks are added, ensuring data integrity without redundant processing.

Three ways teams use the data

Feed the simulation engine with verified data

Monte Carlo simulations require accurate liquidity depth and price distributions. Deterministic data prevents model garbage-in-garbage-out problems that lead to mispriced risk.

Analyze liquidity depth before deploying capital

Examine available liquidity at different price quartiles to understand execution risk and slippage for large positions. Critical for desks managing significant capital.

.png)

Monitor concentration to allocate efficiently

Track concentration metrics like Nakamoto coefficient and power law distributions to identify pools with sufficient depth and diversification. Allocate capital to venues that can handle your size without moving markets.

.webp)

Deliver data however you need it

API access

RESTful endpoints with authentication. Query pools, tokens, and metrics programmatically. Documentation available for all endpoints and parameters.

Custom integrations

White-label data feeds for platforms and protocols. Embed Bitpulse data directly into your dashboards and user interfaces.

Export formats

CSV and JSON exports for offline analysis and internal data warehouses.

What clients say about data quality

Request data coverage

.webp)

.png)