Risk Analysis for Institutional Digital Asset Lending

Mitigate Risk. Optimize Decisions. Protect Your Capital.

Gain real-time visibility into market risks, counterparty exposure, and loan portfolio vulnerabilities with Membrane’s new Risk Analysis solution. Our institutional-grade analytics help lending desks and prime brokers make data-driven decisions with confidence.

Pre- & Post-Trade Risk Modeling

Anticipate Risk. Structure Smarter.

Model scenarios, simulate outcomes, and assess trade risk before and after execution.

Key Benefits

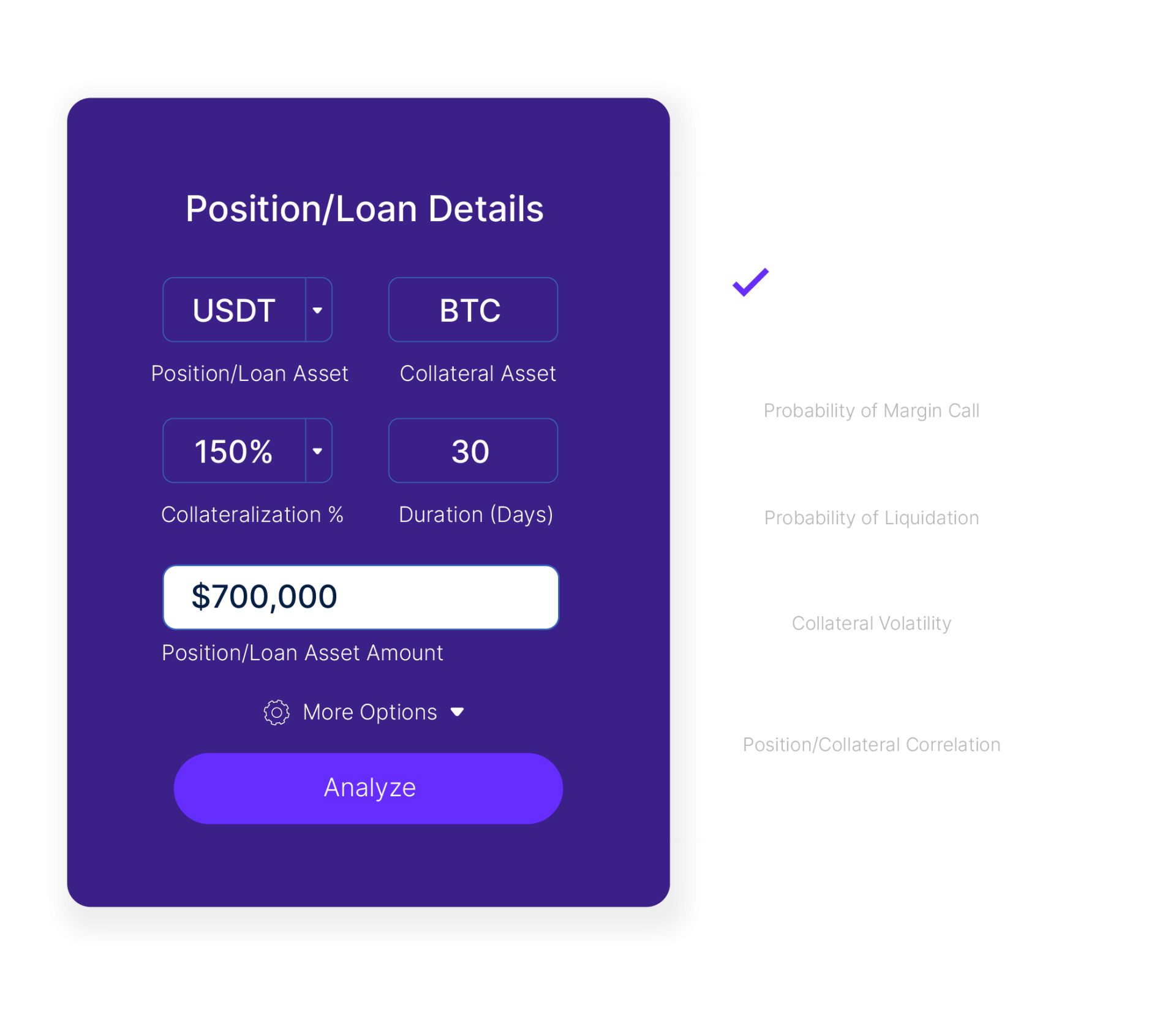

Position Risk Analysis

Quantify the probability of loan failure, liquidation, or stress events over custom timeframes. Leverage historical shocks, empirical models, and Monte Carlo simulations (GBM) to generate forward-looking risk intelligence for any position.

Margin Optimization Modeling

Dynamically optimize loan structures to meet risk thresholds or target scores. Our models recommend ideal LTVs and margin terms based on volatility, market conditions, and custom risk tolerances.

Value at Risk (VaR) Calculations

Project portfolio losses across custom horizons using historical and simulated VaR. Get a unified view of risk exposure across assets and counterparties for traders and CROs.

Cross-Margin Exposure Analysis

Identify systemic risk in complex portfolios by modeling margin covariance across trades, loans, and collateral. Assess concentration and exposure overlap with precision.

Liquidity Stress Testing for Portfolio Optimization

Simulate liquidity-driven drawdowns to assess slippage, market depth, and forced liquidation risk, enabling teams to anticipate and prevent deleveraging events.

Portfolio Risk Analysis

Real-Time Portfolio Intelligence

Risk Infrastructure Built for Institutions, No Matter the Use Case

Model execution depth, slippage, and access constraints across venues. Simulate collateral liquidation and track market impact to optimize exit strategy and preserve capital.

Market Data & Risk Tools

Risk Infrastructure Built for Institutions, No Matter the Use Case

Power your risk calculations with

the highest fidelity, richest data.

Venue-Specific Liquidity Modeling

Model execution depth, slippage, and access constraints across venues. Simulate collateral liquidation and track market impact to optimize exit strategy and preserve capital.

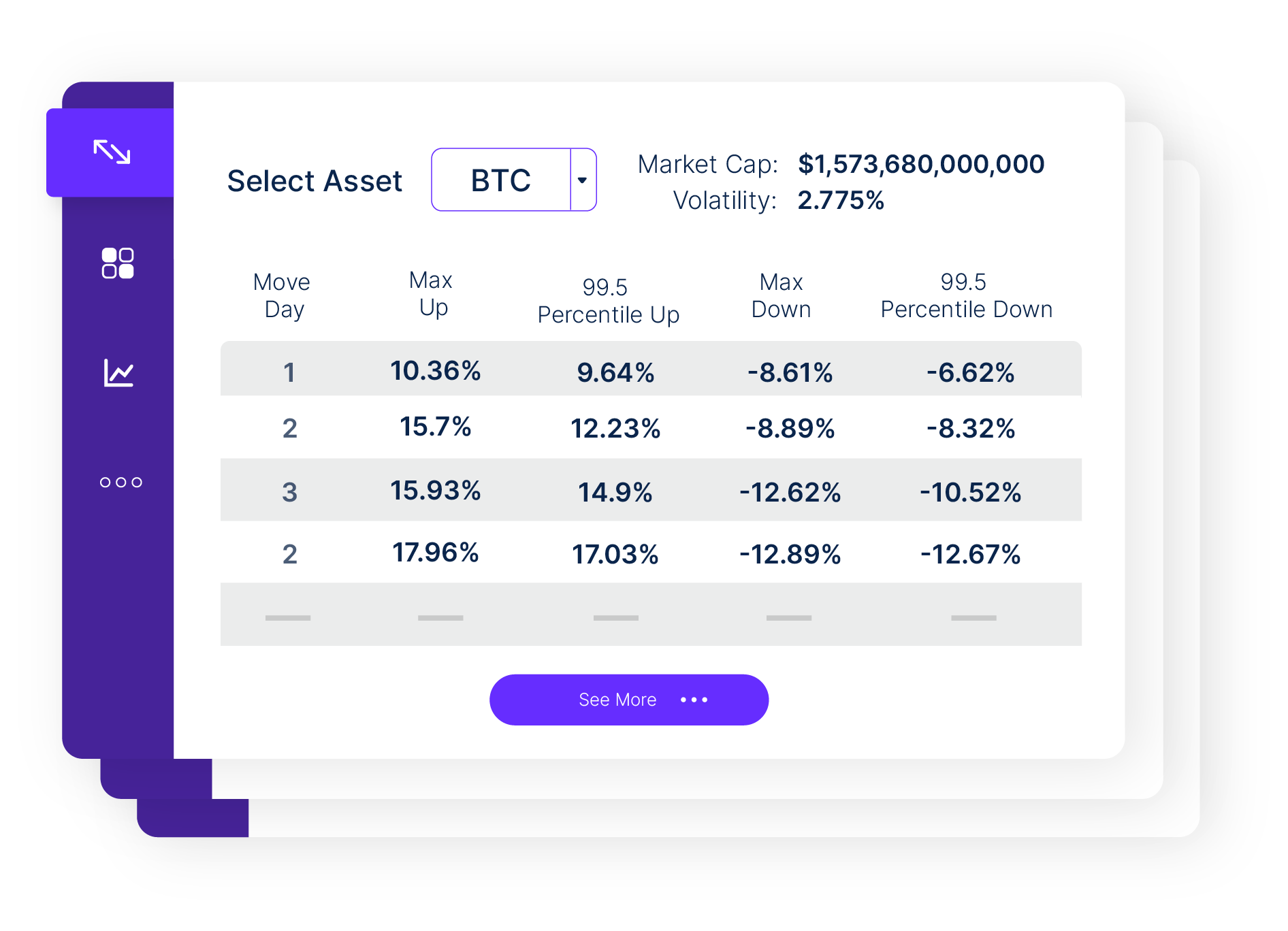

Volatility Intelligence

Tap into real-time and historical volatility, up and down scenarios, correlation matrices in order to power pricing, risk simulations, and shock scenarios with precision.

Scenario Engines & Correlation Tools

Run up/down scenarios across custom horizons using historical asset behavior. Analyze correlation matrices to uncover systemic risk, refine hedging, and improve diversification.

Get early access.

Be the first to access our cutting-edge cryptocurrency underwriting platform.

Sign up now for early access and exclusive insights.